🚗 Car Insurance Prices in Korea — What Really Affects Your Premiums 🇰🇷

Thinking about getting car insurance in Korea? Here are the 4 key factors that determine your premium 👇

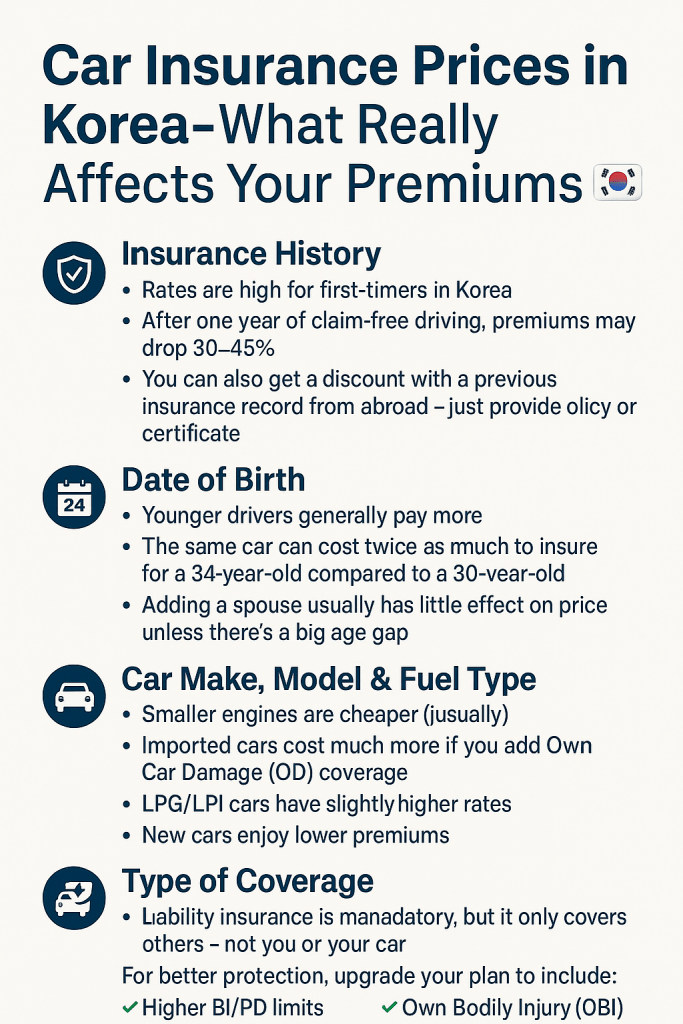

1️⃣ Insurance History

If it’s your first time in Korea, rates can be high.

After one year of claim-free driving, premiums may drop by 30–45%!

You can also get a discount with a previous insurance record from abroad — just provide your old policy or certificate.

2️⃣ Date of Birth

Younger drivers generally pay more.

The same car can cost twice as much to insure for a 24-year-old compared to a 30-year-old.

Adding a spouse usually has little effect on price unless there’s a big age gap.

3️⃣ Car Make, Model & Fuel Type

Smaller engines are cheaper (usually!).

Imported cars cost much more if you add Own Car Damage (OD) coverage.

LPG/LPI cars have slightly higher rates, while new cars enjoy lower premiums.

4️⃣ Type of Coverage

In Korea, liability insurance is mandatory, but it only covers others — not you or your car.

For better protection, upgrade your plan to include:

✅ Higher BI/PD limits

✅ Own Bodily Injury (OBI)

✅ Own Car Damage (OD)

✅ Roadside Assistance (flat tire, battery, towing, etc.)

💡 Bonus Discounts:

✔️ Kids living with you

✔️ Installed black box

📞 Need help choosing the right plan?

Contact Byung Geun Chun — your trusted insurance advisor at Samsung Expat Insurance.

📧 byung625@gmail.com

📱 010-3232-0625

🌐 facebook.com/expatinsurance

SamsungExpatInsurance #CarInsuranceKorea #ExpatLifeKorea #DriveConfidently #InsuranceTips #MotorInsuranceKorea #SeoulLife #ForeignersInKorea #RoadsideAssistance #PeaceOfMind #SamsungFire